|

LOS ANGELES, CA — NOVEMBER 22, 2019 — Centre Urban Real Estate Partners has successfully sold Compass Pointe Apartments comprising of 86 garden-style apartments in Tulsa, Oklahoma for $2.709 million or $31,500 per unit. Compass Pointe is a legacy asset of Tahiti Partners Properties Corporation, which originally purchased the property in distressed condition for $516,000 or $6,000 per unit in early 2010. The property was originally built in 1964. Tahiti Partners successfully executed a renovation and stabilization business plan that saw significant value-creation as demonstrated by the ultimate disposition.

Centre Urban was represented by Evolution Management Corp., an affiliate of Centre Urban, and the buyer was represented by the SVN Oak Realty in the transaction. The sale of Compass Pointe is part of Centre Urban’s efforts to dispose of legacy assets not consistent with its current investment strategy. Located in the northeast plains of Oklahoma, Tulsa is a historic city of nearly half a million people on the banks of the Arkansas River. Known for more than a century as a major oil and gas production center, Tulsa’s economy has grown into the aerospace and technology sectors more and more in the last few decades, and is home to a blossoming media industry as well. Compass Pointe is located in central Tulsa, near major freeways with access to downtown, shopping, medical facilities, and recreation. The 86 units all maintain the ease of apartment living amid beautifully landscaped grounds. Residents have the time to pursue their interests while enjoying maintenance-free living in a family-oriented community, complete with a playground and barbecues. ### For more information: Centre Urban Marketing (213) 265-7505 [email protected]

2 Comments

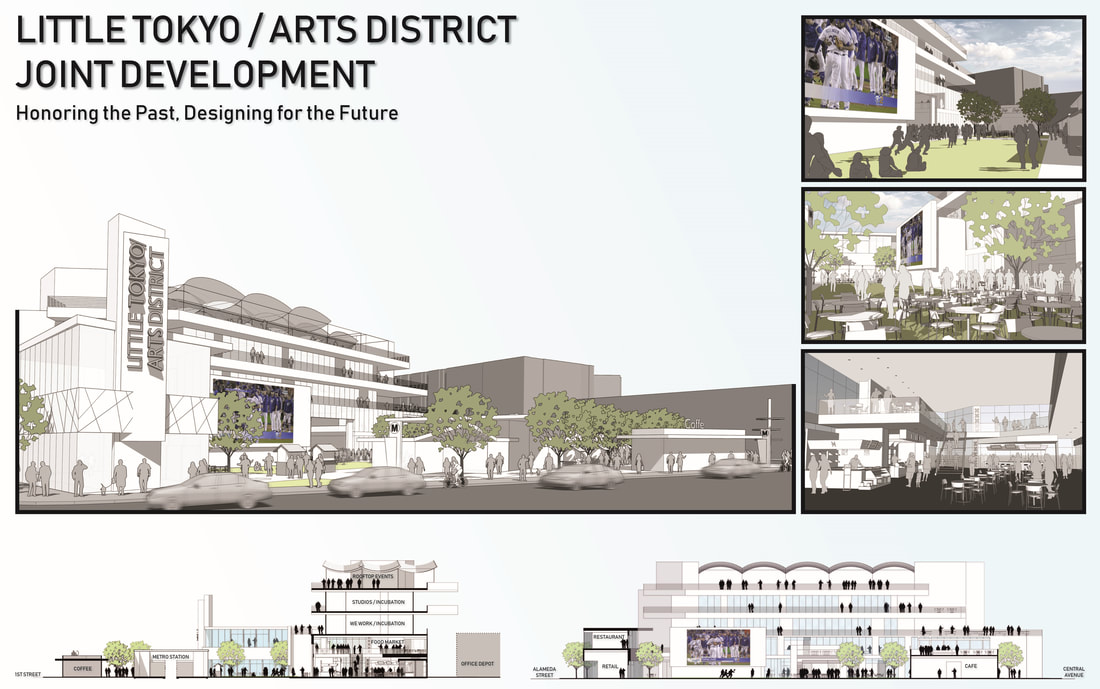

Centre Urban Selected as Finalist for Metro Joint Development of Little Tokyo/Arts District Station10/17/2019 LOS ANGELES, CA — OCTOBER 17, 2019 — Centre Urban Real Estate Partners has been selected as one of four finalists for the joint-development of the future Metro Little Tokyo / Arts District Station, as part of the larger Regional Connector project. In January 2019, Metro received eight different responses from interested parties, which was later whittled down to the top four teams in June. As part of the joint-development process, Metro held two community open houses on October 17, 2019 at the Nishi Hongwanji Buddhist Temple where the four finalists presented early looks at their visions for what could rise above the Little Tokyo / Arts District Station. Community members were asked to provide feedback, which was recorded by Metro staff and will be presented to each development team. Metro hopes to recommend a developer to the Board of Directors in early 2020. The Regional Connector is expected to open in mid-2022. As reported by L.A. Downtown News, "Centre Urban Real Estate Partners’ concept focuses on melding elements from Little Tokyo and the Arts District’s past with the future, according to Martin M. Q. Nguyen, principal at the Downtown-based development firm. “This is a key site and key player to both Little Tokyo and the Arts District,” Nguyen said during the presentation. “This is the crossroad of the historic and traditional history of Little Tokyo, yet the start of the innovative and new concepts that come out of the Arts District.” Centre Urban’s vision for the site, alongside their development partners, Stantec and Kritzinger & Rao, features 20,000 square-feet of creative office space spread across a two-floor building. Visitors will have to cross a large lawn to enter the offices, which will be focused on independent start-ups from the community. An “urban village” will anchor the offices, Nguyen said. A total of six independent retail spaces totaling 2,500-square-feet, a 3,400-square-foot restaurant and an 18,000 square-foot “food village” than can house 22 different stalls and a bar will make up the village. There is also a 1,700-square-feet space for a historic cafe on the Central Avenue side of the site. During the meeting, Nguyen floated the idea of the space eventually holding a revived Atomic Café. The legendary cafe’s historic brick building sat at the construction site for 100-years before being demolished in 2015 to make way for the new station. Additional features include a 500-square-foot mobility hub, a “smart market,” and potential for a rooftop event space." Centre Urban is excited to play a part in this process and hopes to be able to play its part in the positive evolution of the Little Tokyo and Arts District communities.

### For more information: Centre Urban Marketing (213) 265-7505 [email protected] LOS ANGELES, CA — OCTOBER 14, 2019 — Centre Urban Real Estate Partners has successfully sold Pierson Plaza in Riverside County for $11.3 million or $296 per square foot. Pierson Plaza is a legacy asset of Tahiti Partners Properties Corporation, which successfully acquired, designed, entitled, and constructed the 38,084 square-foot office building which was completed in 2017. Tahiti Partners developed Pierson Plaza as a build-to-suit tailored for the Riverside County’s Department of Public Social Services with tenant improvements costing nearly $3.0 million and ultimately stabilized the asset by signing the County to a 10-year lease.

The buyer is a Palm Springs-based real estate investment company that exchanged out of a multifamily property to acquire Pierson Plaza. Centre Urban was represented by CBRE and the buyer was represented by the McLean Company in the transaction. Pierson Plaza is located in the heart of the downtown area, across the street from Desert Hot Springs High School and Desert Hot Springs Library. The asset is also seven miles north of the I-10 freeway that connects the Coachella Valley to Riverside and Los Angeles Counties. “This listing provided the extremely rare opportunity to acquire a brand new, single-tenant office building in the Coachella Valley,” said Gary Stache of CBRE. “The Coachella Valley has extremely strong market fundamentals, and the area is forecasted to grow from 369,000 to nearly 500,000 total seasonal/full-time residents by 2020. The buyer realized the incredible value in acquiring such a unique asset in one of Southern California’s fastest-growing submarkets.” More than 160,000 square-feet have been leased in the second quarter, following a moderate start to the year, further lowering the Inland Empire’s overall office vacancy rate to 8.6 percent, according to a CBRE research report. This marked the Inland Empire’s fifth consecutive quarter in single-digit vacancy. LOS ANGELES, CA — AUGUST 9, 2019 — Centre Urban Real Estate Partners has successfully sold, at an undisclosed price, Verdana by Davall Place, a fully entitled development project comprised of 27 finished lots located in the City of Rancho Mirage. Verdana is a legacy asset of Tahiti Partners Properties Corporation, which successfully acquired, designed, entitled, and disposed of the quasi-custom lots, including the annexation of the property into the prestigious City of Rancho Mirage from County of Riverside jurisdiction. Verdana represents the only available semi-improved & final map ready-to-record opportunity in the entire city of Rancho Mirage. The sale of Verdana is part of Centre Urban’s efforts to dispose of legacy assets not consistent with its current investment strategy.

Verdana will be a ±10-acre gated community offering modern, reasonably-priced homes in the $700k’s compared to the $1M+ comparable home prices. The property backs up to the sold out (last cycle) community of Tuscany to the south and is adjacent to the new state-of-the-art Rancho Mirage High School. Mission Hills Golf Resort & Spa - with 36 holes open year-round - is a golf cart ride away located just across Ramon Road. Rancho Mirage is known as one of the most affluent cities in Riverside County with an average household income of $109,708. Some of America’s finest golf courses, most exclusive residential communities, and international events such as the annual Kraft Nabisco Championship. Many famous people have made Rancho Mirage their home including President Gerald R. Ford upon his retirement from the U.S. Presidency. ### For more information: Centre Urban Marketing (213) 265-7505 [email protected] LOS ANGELES, CA — MARCH 18, 2019 — Charles Bogusz has jointed Centre Urban Real Estate Partners, as Vice President of Finance & Development, where he will focus primarily on debt strategies and advisory. Mr. Bogusz has over 30 years of mortgage lending, real estate management, client relations, contract negotiations, real estate finance and portfolio maximization experience handling both residential and commercial real estate. He worked as a commercial loan officer for national lender offering loans both directly to clients and on a wholesale bases to mortgage brokers through the years. He has served on the national board of REOMAC, as a writer for their national magazine and webinar host for the REOMAC Commercial Council.

In his most recent assignment, he served as Vice President at Provident Bank where he originated $20 million in commercial real estate transactions. As a Loan Officer for American First Credit Union, Mr. Bogusz closed over $30 million in CRE loans. He earlier managed assets for NRT, parent company of Coldwell Banker, Sotheby’s and ERA, selling almost $750 million in real estate. Prior, he managed commercial loans as a Vice President at City National Bank. Mr. Bogusz notably closed over $500 million in real estate transactions for Countrywide Home Loan; awarded their Walk of Fame Award for outstanding service both as a Loan Officer and an REO Manager. After relocating to Los Angeles, Charles joined Continental Savings handling residential loans for a star-studded clientele including Dan Ackroyd, Michael J. Fox, Bronson Pinchot and Hal Holbrook. Prior, he helped Household Bank establish a lending division throughout Southern California where he earned Presidential Award honors. Mr. Bogusz stated his career in Miami, Florida with Ameri-First Savings. Charlie has been an AYSO soccer coach for the last 22 years and serves as a Boy Scout mentor in Woodland Hills, California where he lives with his wife Marci and occasionally his two collegiate sons, Jake and Noah. Bogusz attended Indiana University where he received his Bachelor of Science Business Administration and Management, Economics. ### The Centre Urban team is excited to have Charlie join us and look forward to much future success with him on board. Centre Urban offers brokerage and advisory services, in addition to its own investment and development platforms. For more information on these debt strategies, please contact: Charles Bogusz Vice President, Finance & Development (818) 426-4152 [email protected] LOS ANGELES, CA — MARCH 13, 2019 — The USC Alumni Day of SCervice is an opportunity for all alumni and friends to participate in local service volunteer projects organized by USC alumni clubs, chapters and other affiliated groups worldwide. On March 9, 2019, thousands of USC Trojans gathered across the globe to make a difference in their communities. Members of the Centre Urban team, over the past weekend, participated in furthering our communities with the rest of the Trojan Family.

Eugene Page, Principal and Head of Advisory & Brokerage volunteered with the USC Alumni Real Estate Network and City Plants planted trees in the San Fernando Valley. This year, the Alumni Real Estate Network provided the opportunity to shape a climate-resilient and sustainable Los Angeles by planting over 180 trees within a two-block radius around the Van Nuys Recreation Center. Martin Nguyen, Principal volunteered with the USC Asia-Pacific Alumni Association Young Alumni Council at the Ketchum-Downtown YMCA in downtown Los Angeles. The Young Alumni Council helped mentor high school students as they prepare for college and assisted with youth sports activities through the day. The Centre Urban team wholeheartedly believes that being a part of the community means truly engaging and participating in the positive efforts it takes to have it grow. Through volunteering our time, mentoring the next generation of leaders, or facilitating the grown of the urban fabric, the Centre Urban team hopes to contribute our part - no matter how big or small - in creating a better Los Angeles for all. For more information: Centre Urban Marketing (213) 265-7505 [email protected] LOS ANGELES, CA — FEBRUARY 18, 2019 — Centre Urban Real Estate Partners, on behalf of a high-net worth client, closes on the $1.8 million acquisition of a 8-unit multifamily asset located in the expanding submarket of Baldwin Hills Estates. The asset was purchased at a 5.0% cap rate with an average 30% loss-to-lease factor, leaving significant rental upside. The acquisition is the beginning of Centre Urban's effort to re-balance the client's legacy real estate portfolio, which includes a number of out-of-state tertiary assets.

The seller had renovated the property exterior as well as two of the eight units. Centre Urban, cognizant of our client's desire for a stable asset with potential upside, has put into place a business plan that calls for the steady renovation of units as tenants naturally turn over. Centre Urban, along with sourcing and managing the acquisition process, utilized its extensive network to secure a low-leverage bridge loan in order to fund the required soft-story retrofit of the asset, with the intention of refinancing into a permanent loan upon completion of work. "This property offers our clients a rare opportunity to invest in an urban West LA asset at a comparatively low basis - $218K a unit - yet with significant potential upside. With all the activity in Culver City and West Adams, we are excited to manage and execute this business plan on behalf of our clients" said Eugene Page, Principal of Centre Urban Real Estate Partners. The asset is located within a five-mile radius of the expansive Kenneth Hahn State Park, Jim Gilliam Recreation Center, Baldwin Hills Elementary School, brand new Kaiser Permanente, and the Baldwin Hills Plaza. ### Centre Urban offers brokerage and advisory services, in addition to its own investment and development platforms. For more information on these services, please contact: Eugene F. Page Principal, Brokerage & Advisory (213) 265-7505 [email protected] LOS ANGELES, CA — FEBRUARY 5, 2019 — Real estate veterans Eugene Page and Geoffrey Payne have merged their respective companies, Optimal Real Estate, Inc. and Tahiti Partners Properties Corporation, to establish Centre Urban Real Estate Partners, a full-service commercial real estate investment and development group, focusing on innovative place-making in the residential, multifamily, and commercial mixed-use asset classes, with a secondary focus on select hospitality investments. Newcomer Martin Nguyen, a graduate of the Dollinger Master of Real Estate Development program at the University of Southern California and RealtyMogul.com alum, has also joined the firm as a principal.

Page has over 35 years of real estate experience and holds broad expertise in strategy consulting, marketing, workouts, re-positioning, and brokerage. Prior to founding Optimal Real Estate, Page was previously a senior managing director at the Charles Dunn Company, opening the Company’s North Orange County office. Prior, he co-led the worldwide Organizational Strategy practice for Jones Lang LaSalle and directed Price Waterhouse Coopers (PwC)’ Corporate Real Estate Consulting Service where, most notably, he was a member of the team that represented the creditor during the Rockefeller Center bankruptcy in the 1990s. Earlier in his career, he was a principal at Knight Frank Faulkner and was with Cushman & Wakefield. Page received his MBA from the University of Southern California. As a lawyer, contractor, accountant, and developer, Payne has been acquiring, developing and managing projects for over 40 years. He founded Tahiti Partners Properties Corporation in 1999 and oversaw the development of over 100 high-end homes in addition to commercial, multifamily, and residential projects throughout the western United States. Prior, Payne practiced law at several firms including Century City-based Cox, Castle & Nicholson, where he focused on land-use and entitlement while representing a number of high-profile real estate clients. He received his Juris Doctor from Loyola Law School. Prior to practicing law, Payne worked at Hughes Aircraft as a controller for US government defense programs. Nguyen has accumulated over $2.5 billion worth of finance and underwriting experience through his professional career. He was previously at RealtyMogul.com, in their Los Angeles and New York City offices, where he underwrote national assets ranging from traditional multifamily and commercial properties to specialized asset classes such as hospitality, student housing, and self-storage. Nguyen has covered a number of structured finance products, including joint venture equity, preferred equity, mezzanine debt, and variations of senior debt. While at USC, he was recognized with Honors for Outstanding Performance in both Finance and Design for his Comprehensive Exam and is one of the youngest-ever graduates of the distinguished MRED program. The merger combines a successful investing track record with established service experience to form a true full-service real estate investment platform. Focusing on innovative investment and development strategies, Centre Urban’s principals take decades of institutional experience and pairs it with an entrepreneurial mindset to further the on-going evolution of Los Angeles’s urban fabric. “By emphasizing placemaking, architectural sophistication, and functionality Centre Urban will maximize enjoyment, use, and livability at all of our projects” Page said. Centre Urban and its legacy companies completed over $500 million in full-cycle transaction value and its principals have over 80 years of combined real estate experience. Centre Urban primarily takes an opportunistic investment approach, concentrating on non-traditional and unorthodox properties where value can be maximized through innovative thinking. Investment strategies include entitlement joint-ventures with existing landowners, development of micro-units, co-living, or co-working space, value-add/adaptive reuse of existing structures, and general transit-oriented development. In addition to investment and development, Centre Urban will continue to offer ancillary real estate brokerage and advisory services. Centre Urban is targeting new investment and client opportunities valued upwards of $5 million located in urban Southern California. Centre Urban continues to raise capital from high-net worth individuals, family offices, and various institutional partners. For more information: Centre Urban Marketing (213) 265-7505 [email protected] |